What is the One Big Beautiful Bill Act? A Complete Guide to 2025 Tax Changes for Individuals

Are you wondering how recent tax legislation will affect your 2025 tax return? On July 4th, President Trump signed the "One Big Beautiful Bill Act" (OBBBA), creating major changes to federal tax policy. This legislation permanently extends many Tax Cuts and Jobs Act provisions while adding new benefits for individual taxpayers.

At Elmira Tax, our experienced team has been analyzing the One Big Beautiful Bill Act provisions to help our clients navigate these complex changes. This comprehensive guide breaks down everything you need to know about how the OBBBA will impact your tax situation.

Understanding the One Big Beautiful Bill Act: Key Provisions and Timeline

The One Big Beautiful Bill Act represents comprehensive tax reform since the 2017 Tax Cuts and Jobs Act. This legislation addresses immediate tax concerns and long-term financial planning for American families

Historical Context: From TCJA to the One Big Beautiful Bill Act

The House bill extends or makes permanent corporate, international and individual tax provisions from the Tax Cuts and Jobs Act (“TCJA”) of 2017. The original TCJA introduced temporary tax provisions that were set to expire after 2025.

When the One Big Beautiful Bill Act Takes Effect: Important Dates for Taxpayers

Most provisions became effective July 4, 2025. However, implementation varies by provision. Most provisions will impact 2025 tax returns to be filed in 2026. While some benefits are permanent, others contain sunset clauses requiring future congressional action.

Major Tax Changes in the One Big Beautiful Bill Act for Individual Taxpayers

The One Big Beautiful Bill Act introduces substantial changes affecting millions of American taxpayers. These range from expanded deductions to new credits for working families and retirees.

Standard Deduction Increases Under the One Big Beautiful Bill Act

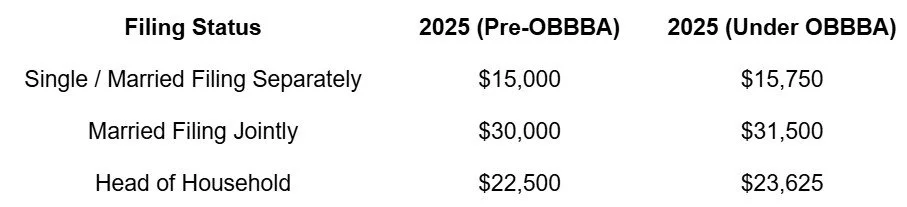

The OBBBA increases the standard deduction:

This increase simplifies filing for many and reduces taxable income.

Senior Citizens Additional Deductions ($6,000 Bonus)

The legislation introduces a new $6,000 additional deduction for taxpayers aged 65 and older. For married couples where both spouses are 65 or older, this provides up to $12,000 in additional tax-free income annually.

The deduction phases out at incomes of $75,000 (single) / $150,000 (joint), and is fully phased out at $175,000 / $250,000.

It also requires a Social Security number valid for work and isn't available for married taxpayers filing separately.

State and Local Tax (SALT) Deduction Updates

The One Big Beautiful Bill Act modifies the $10,000 SALT cap. The cap is raised to $40,000 for incomes under $500,000 ($250,000 for married filing separately).

If Modified Adjusted Gross Income exceeds $500,000, the cap is gradually phased down for incomes between $500,000 and $600,000, where the cap is reduced to $10,000.

The cap and income threshold increase by 1% annually through 2028, before reverting back to $10,000 in 2029.

Child Tax Credit Enhancements

The Child Tax Credit increases permanently from $2,000 to $2,200 per child with automatic inflation adjustments each year. Permanent phaseout thresholds start at income of $200,000 ($400,000 if Married Filing Jointly).

The credit is partially refundable up to $1,700 for 2025, and will be indexed for inflation.

Social Security numbers are required for the taxpayer claiming the credit and for the child.

No Tax on Tips

The legislation eliminates federal income tax on tip income for service industry workers through 2028.

Income eligible for deduction is capped at $25,000. Higher income workers may claim partial deductions as the benefit phases out starting at income of $150,000 (Single) / $300,000 (Married Filing Jointly).

The deduction requires a Social Security number valid for work and isn't available for married taxpayers filing separately.

Note that this deduction only applies to income taxes. Tip income will continue to be subject to Social Security and Medicare taxes.

No Tax on Overtime

The One Big Beautiful Bill Act eliminates federal income tax on overtime compensation for hourly workers through 2028.

Income eligible for deduction is capped at $12,500 (Single) / $25,000 (Married Filing Jointly), with phase-out beginning at income of $150,000 (Single) / $300,000 (Married Filing Jointly).

Similar to the No Tax on Tips provision above, this deduction also requires a Social Security number valid for work and isn't available for married taxpayers filing separately.

Note that this deduction only applies to income taxes. Overtime income will continue to be subject to Social Security and Medicare taxes.

Car Loan Interest Deduction

The legislation introduces a deduction for interest paid on automobile loans, similar to mortgage interest deduction. The deduction is limited to $10,000 of qualified interest. This deduction only applies to new vehicles purchased in 2025 or later, and have final assembly in the U.S.

The deduction phases out beginning at income of $100,000 (Single) / $200,000 (Married Filing Jointly), and is fully phased-out at income of $150,000 (Single) / $250,000 (Married Filing Jointly).

Charitable Donations Deduction Changes

The One Big Beautiful Bill Act allows all taxpayers to deduct charitable contributions regardless of whether they take the standard deduction or itemize their deductions. Under the old law, taxpayers can only deduct charitable contributions if they itemize their deductions.

Under the new law, taxpayers who take the standard deduction can deduct up to $1,000 (Single) / $2,000 (Married Filing Jointly) on top of the standard deduction.

On the other hand, taxpayers who itemize their deductions must now reduce their deduction by 0.5% of adjusted gross income.

Remittance Tax

The legislation includes a 1% excise tax on cash transfers by individuals from the U.S (includes U.S. territories and Puerto Rico) to a foreign country. The tax is required to be withheld and remitted to the IRS by the remittance transfer provider at the time of the remittance.

Several notable exceptions to the tax include:

Transfers funded with a U.S. issued debit or credit card

Transfers for which the funds are withdrawn from accounts held in or by FDIC insured banks, commercial banks or trust companies, private bankers, an agency or branch of a foreign bank in the U.S., any credit union, a thrift institution, a broker dealer registered with the SEC, and/or a broker/dealer in securities or commodities.

Transfers of virtual currency such as cryptocurrency and stablecoins

Prior versions of the bill had included exceptions for U.S. citizens and nationals. However, the bill as enacted does not include any such exception, and will apply to all individuals regardless of nationality.

This tax will be effective for transfers initiated after December 31, 2025.

529 Plan Changes

The One Big Beautiful Bill Act expands 529 education savings plans beyond higher education. Funds can now be used for K-12 expenses up to $20,000 (increased from $10,000). Additional qualified expenses include books, online learning materials, tutoring fees, and credentialed program costs. This makes 529 plans more attractive for comprehensive education planning.

Repeal of EV Credit & Residential Credits

The legislation eliminates electric vehicle tax credits and residential energy improvement credits after September 30, 2025. This affects planning for environmentally-focused purchases.

Taxpayers planning purchases based on these credits should evaluate timing carefully due to the approaching deadline.

Trump Savings Account

Starting in 2026, new tax-advantaged savings accounts for children under 18 allow up to $5,000 annual after-tax contributions. This will be adjusted for inflation starting in 2027. The federal government also provides a one-time $1,000 contribution for U.S. citizens born between 2025 and 2028.

Employers may contribute up to $2,500 to the account for their employees as a fringe benefit if they choose, but this will count towards the $5,000 limit. The $2,500 will not be taxable to the employee.

When the child turns 18, the account turns into a Traditional IRA, and adheres to the withdrawal rules of a Traditional IRA. No withdrawals are allowed until the child turns 18, but may be subject to income tax and early withdrawal penalties if withdrawn before they turn 59 ½, unless the withdrawal qualifies for certain exceptions. The exceptions are similar to those of a Traditional IRA, including higher education expenses and first-home purchase.

Child & Dependent Care Credit Expansion

Starting in 2026, the maximum credit percentage increases to 50% of qualified expenses.

Phase-down of the credit occurs based on the table below.

The threshold of expenses remains unchanged at $3,000 for 1 child and $6,000 for 2 or more children.

How the One Big Beautiful Bill Act Affects Your 2025 Tax Filing

Understanding practical implications is crucial for proper tax planning and compliance. These changes directly impact how you prepare and file your 2025 tax return.

Form Updates and Documentation Needed

Tax forms are being updated for One Big Beautiful Bill Act provisions. Taxpayers will likely receive new informational forms in relation to these provisions such as car loan interest, Trump Savings Accounts, etc.

Therefore, taxpayers who are affected by these new provisions should keep a look out for these potential new tax forms.

Tax Software and Professional Preparation Considerations

Tax software updates may cause early-season delays or accuracy issues. Professional preparers are receiving training, but complex provisions may require additional consultation time.

At Elmira Tax, we're investing in continuing education and software updates for accurate preparation. We recommend early consultation scheduling for proper planning.

One Big Beautiful Bill vs. Previous Tax Law: What Changed?

Comparing the One Big Beautiful Bill Act to previous legislation reveals the scope of changes affecting individual taxpayers. Understanding differences is essential for effective planning.

Comparison with Tax Cuts and Jobs Act (TCJA) Provisions

The One Big Beautiful Bill Act preserves most favorable TCJA aspects while addressing shortcomings. It makes permanent individual tax rates of 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Unlike TCJA's temporary rates, the new law provides permanent certainty. Standard deduction increases build upon TCJA improvements with additional relief and inflation protection.

Key additions include senior citizen bonus, expanded child tax credit, and new deductions for tips, overtime, and car loan interest not in original TCJA.

Permanent vs. Temporary Tax Changes

Most individual tax benefits are now permanent, providing certainty for long-term planning and eliminating need for future congressional action to prevent tax increases.

Temporary provisions include enhanced provisions through specific dates and phase-in periods. However, even temporary provisions include inflation adjustments.

This represents a legislative shift recognizing that tax uncertainty hampers economic planning for families and businesses.

Phase-Out Provisions and Future Implications

Several provisions include income-based phase-outs targeting benefits toward middle-class taxpayers. The senior bonus phases out at higher incomes, as do enhanced child tax credits.

Phase-outs provide maximum benefit to taxpayers needing relief most while managing fiscal cost. Understanding thresholds is crucial for planning, especially for taxpayers near phase-out ranges.

Future implications include possible legislative adjustments if economic conditions change or revenue needs require modifications.

Planning Strategies for the One Big Beautiful Bill Act Tax Changes

Effective tax planning requires understanding how to maximize benefits under the new law while positioning for future opportunities. The Act creates numerous planning possibilities for taxpayers.

Year-End Tax Planning Considerations for 2025

Income and deduction timing becomes more complex under the new law. Taxpayers should evaluate whether to accelerate or defer income based on projected brackets and available deductions.

For seniors, the $6,000 bonus may change optimal timing of retirement distributions or Roth conversions. Additional deduction space could make realizing additional income beneficial.

Families should coordinate charitable giving with expanded deduction opportunities, particularly near the itemizing threshold.

Estate Planning Impacts and Strategies

Higher estate and gift tax exemptions affect wealthy families' planning strategies. Increased exemptions provide more tax-free wealth transfer opportunities to future generations.

Trump Savings Accounts create new tax-advantaged wealth building opportunities complementing traditional retirement accounts. Broader withdrawal options make these suitable for multi-generational planning.

Families should review existing plans to leverage enhanced exemptions and new planning tools.

Investment and Capital Gains Planning Under New Rules

New deductions create optimization opportunities for investors. Additional deduction space may make realizing capital gains beneficial in certain years.

Taxpayers should coordinate investment timing with income planning to maximize available deductions and credits. Permanent provisions allow longer-term planning strategies.

Trump Savings Accounts provide new tax-advantaged investment growth options alongside traditional retirement strategies.

Ready to maximize the new tax changes? Contact Elmira Tax today to schedule a consultation with our experienced team. We'll review your situation and develop a customized strategy to help you take full advantage of One Big Beautiful Bill Act opportunities.

Book Your Consultation Now!

Fill up the form below and we will get back to you within a day!

Important Disclaimer: This article provides general tax law information and should not be considered personalized tax advice. Tax situations are unique, and optimal strategies depend on specific circumstances. Elmira Tax professionals are available for personalized consultations to help you understand how the One Big Beautiful Bill Act affects your situation.