Augusta Rule: Complete Guide to Tax-Free Rental Income for Business Owners

What if you could legally rent your home to your own business and receive tax-free income—up to 14 days per year? That’s exactly what the Augusta Rule allows.

At Elmira Tax, our CPAs help business owners maximize this benefit while staying fully compliant with IRS regulations. Here's your complete guide to the Augusta Rule..

What is the Augusta Rule? (Section 280A Explained)

This section explains what the Augusta Rule is, the IRS code it comes from, and how it works for business owners.

Definition and Official IRS Code Section 280A(g)

The Augusta Rule is a nickname for Section 280A(g) of the Internal Revenue Code.

This provision allows homeowners to rent out their primary residence for up to 14 days per year without reporting that income on their tax return—if certain criteria are met. This income is completely tax-free.

Historical Background: From Masters Tournament to National Tax Law

The rule originated in Augusta, Georgia, where residents rented out their homes during the Masters golf tournament. Congress formalized the rule in the tax code to allow these short-term rentals without triggering taxable income. Today, business owners across the U.S. use it for legitimate business purposes.

How the Augusta Rule Works in Practice

If you own a business and use your home for business-related events—like strategy meetings or team planning sessions—you can rent it to your business for up to 14 days per year. Your business deducts the rental expense, and you as the homeowner receive that rental income tax-free.

Augusta Rule Requirements and Eligibility Criteria

Before using the Augusta Rule, business owners must meet specific IRS conditions. This section outlines who qualifies and how to do it properly.

14-Day Rental Limitation: Complete Breakdown

You can only rent your residence for 14 days or fewer in a calendar year. Even renting it for 15 days disqualifies the entire tax-free benefit. Days do not have to be consecutive, but you must keep a clear record of each day used.

Business Entity Requirements (S-Corp, C-Corp, Partnership, LLC)

Your business must be a separate legal entity (not a sole proprietorship). S-Corps, C-Corps, LLCs, and Partnerships all qualify. Your business must have a legitimate need to rent the space and must document the business use.

Fair Market Value Pricing Standards

You must charge your business a fair market rental rate—similar to what others would pay to rent comparable meeting space in your area. Overpricing could result in disallowed deductions and IRS scrutiny. Using local comparables or a written appraisal helps justify your pricing.

How to Use the Augusta Rule for Maximum Tax Benefits

This section outlines the actionable steps business owners need to follow to properly implement the Augusta Rule and claim tax-free income.

Step-by-Step Implementation Process

Determine the number of rental days (maximum 14).

Set a fair rental rate per day.

Schedule business-related activities at your home.

Have your business pay the rental fee.

Refrain from reporting the income on your personal tax return.

Documentation and Record-Keeping Requirements

Keep records including:

Invoices or receipts issued to your business

Meeting agendas or event details

Attendee lists

Copies of checks or payment records

Rental comps to justify pricing

Written Rental Agreement Templates and Best Practices

Your rental agreement should include:

Names of renter and property owner

Property address

Rental amount and payment method

Purpose of rental (e.g., strategic planning)

Dates and duration of use

We recommend having an attorney or CPA at Elmira Tax review the agreement..

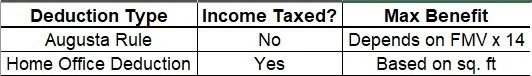

Augusta Rule vs Home Office Deduction: Which is Better?

Many business owners confuse the Augusta Rule with the home office deduction. Here's how the two differ and when one may be preferable over the other.

Tax Savings Comparison and Calculations

The Augusta Rule provides completely tax-free income, while the home office deduction reduces taxable income but doesn’t eliminate it.

When to Choose Augusta Rule Over Home Office Deduction

Use the Augusta Rule when:

Your business holds occasional meetings or training sessions at home

Your home is not your regular workplace

You want to avoid depreciation recapture

Choose the home office deduction if:

You use a dedicated space exclusively and regularly for business

You work from home full-time

Common Misconceptions About Combining Both Deductions

You can use both deductions—but not for the same space and same use. For example, if you claim a home office for daily work, you can still rent another area of your home (like your living room) for a business event under the Augusta Rule, as long as it's documented separately.

Business Use Cases and Legitimate Activities for Augusta Rule

To qualify, the rental must serve a business purpose. This section provides examples of legitimate business uses.

Board Meetings and Strategic Planning Sessions

If you're a corporation or partnership, board meetings and annual strategy sessions qualify as valid business activities for using the Augusta Rule. Maintain meeting agendas and attendee notes.

Client Entertainment and Business Events

Hosting client events such as seminars, investor briefings, or appreciation dinners at your home can qualify—so long as they are business-focused and well documented.

Employee Training and Team Building Activities

In-person employee trainings, workshops, or offsite team building sessions can also qualify. These events must be business-related, scheduled in advance, and documented with sign-in sheets or training materials.

Common Augusta Rule Mistakes and IRS Red Flags

Improper use of the Augusta Rule can lead to audits or penalties. Here’s what to avoid.

Overpricing Rental Rates: Tax Court Cases and Penalties

IRS has ruled against business owners who charged inflated rental rates. One Tax Court case denied deductions where the business paid $5,000 per day without evidence of comparable local rates. Always research and justify your pricing.

Exceeding 14-Day Limit Consequences

Exceeding the 14-day limit—even unintentionally—voids the exclusion. The entire rental income becomes taxable. Track your usage with a calendar or project tracker.

Documentation Failures That Trigger Audits

Lack of proper contracts, agendas, or payment records can result in IRS disallowing the deduction. Treat this like any other arm’s-length transaction between separate parties.

Augusta Rule Tax Planning Strategies

Strategic planning can help you maximize the Augusta Rule and integrate it into your broader tax strategy.

Maximizing Annual Tax Savings Potential

Example: If the fair market rate is $1,000/day and you rent for 14 days, that’s $14,000 in tax-free income. Combined with your business’s deduction, you could save $3,000–$5,000 in taxes annually, depending on your tax bracket.

Integration with Other Business Tax Deductions

Coordinate your Augusta Rule rental with:

Business meals (if part of the event)

Training materials or speaker fees

Professional service deductions This ensures your rental event becomes part of a broader tax-saving strategy.

Year-End Planning and Timing Considerations

Plan your Augusta Rule events early. Last-minute scheduling in December may raise suspicion. Space them throughout the year for better compliance optics and smoother documentation.

Ready to take advantage of the Augusta Rule for your 2025 return? Book a consultation with a CPA at Elmira Tax to ensure you implement it correctly and maximize your tax-free income.

Book Your Consultation Now! Fill up the form below and we will get back to you within 1 day!

Disclaimer: This article is for informational purposes only and does not constitute legal or tax advice. Always consult with a qualified tax professional regarding your specific situation.